mobile county al sales tax registration

251 574 - 4800 Phone. This is the total of state county and city sales tax rates.

How To Register For A Sales Tax Permit In Alabama Taxvalet

Friday July 15 2022 and ends at midnight Sunday July 17 2022.

. Monday Tuesday Thursday Friday 700am. Drawer 1169 Mobile AL 36633. This is the total of state and county sales tax rates.

Alabama Legislative Act 2010-268. Once you register online it takes 3-5 days to receive an account number. This rate includes any state county city and local sales taxes.

The Mobile County sales tax rate is. A mail fee of 250 will apply. If you have questions please contact our office at.

Information Motor Vehicle Business License Sales Tax Online Filing Using ONE SPOT-MAT. The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales. New Tax Bill Search.

Baldwin County is participating in the 2022 Back to School Sales Tax Holiday. The minimum combined 2022 sales tax rate for mobile alabama is. Contact Information 251 574 8530.

NOTICE TO PROPERTY OWNERS and OCCUPANTS. Mobile County Revenue Commission. 243 PO Box 3065 Mobile AL 36652-3065 Office.

This tax is in lieu of. In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal. See information regarding business licenses here.

Section 34-22 Provisions of state sales tax statutes applicable. Or Section 28-3A-21a15 Code of Alabama 1975. Mobile County Tax Rates.

2020 rates included for use while preparing your income tax deduction. Vendor Registration Payment Center Tax Payments Bids Real Estate Listings Auctions Financial Reports Revenue Department. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales.

10 rows Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as. Revenue Office Government Plaza 2nd Floor Window Hours. Sales tax sales tax rates range from 35 to 6 depending on the registration.

Revenue Department 205 Govt St S. What is the sales tax rate in Mobile Alabama. The minimum combined 2022 sales tax rate for Mobile Alabama is 10.

The Holiday begins at 1201 am. The 2018 United States Supreme Court decision in. The latest sales tax rate for Mobile AL.

Mobile County Sales Tax Form. Per 40-2A-15h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self-administered county or municipality may. However However pursuant to Section 40-23-7.

Vendor Registration Payment Center Tax Payments Bids Real Estate Listings Auctions Financial Reports Revenue Department. The Alabama state sales tax rate is currently. Online Filing Using ONE SPOT-MAT.

Which Involves the collection of monthly Sales Use Taxes. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types.

How To Register A Car In Alabama Yourmechanic Advice

The Press Register Ballotpedia

Licenses Permits Taxes City Of Livingston

Mobile County Al Sales Tax Rate Sales Taxes By County October 2022

Fillable Online Revenue Alabama Application For Sales And Use Tax Certificate Of Exemption Revenue Alabama Fax Email Print Pdffiller

Vehicle Registration For Military Families Military Com

Alabama Tax Title Registration Requirements Process Street

How To Get A Sales Tax Permit In Alabama Youtube

Mobile County License Commission Office In Eight Mile Closing For Renovations Al Com

Filing An Alabama State Tax Return Things To Know Credit Karma

/https://s3.amazonaws.com/lmbucket0/media/business/rangeline-rd-halls-mill-rd-2-5LSV-1-4FgZi6YI1xlduK8-w00yYP2JGsp8B4H64lx0Q7NLlzg.bed069a92292.jpg)

T Mobile Rangeline Rd Hwy 90 Mobile Al

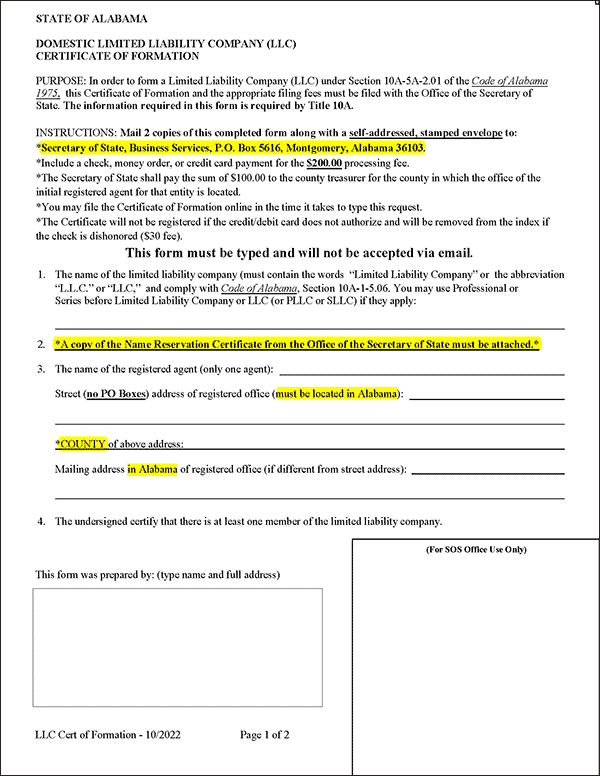

Llc In Alabama How To Start An Llc In Alabama Truic

Alabama Severe Weather Awareness Week

Alabama Sales Tax Guide And Calculator 2022 Taxjar

/https://s3.amazonaws.com/lmbucket0/media/business/alabama-lugonia-9759-1--UL3h8k7rcrao_1BabAvcZOk-dLkyFjwZe0atyZo7sg.cc47255504f0.jpg)